Optimizing the Brex Onboarding Experience

Brand

Brex (Corporate Card & Spend Management Platform)

Role

UX Designer

Timeline

October 2025 (1 month)

Scope

Onboarding Flow Analysis + UX Redesign Proposal

Overview

Brex is a leading U.S. corporate card and financial operations platform used by startups to enterprise-level companies.

However, its onboarding experience requires users to complete extensive identity and business verification before accessing the product, resulting in friction, uncertainty, and high cognitive load.

As a UX designer specialized in fintech, I conducted a comparative analysis of Brex and Ramp's onboarding flows to uncover user pain points, identify compliance-driven constraints (KYC/AML), and propose AI-assisted design solutions that streamline the process while maintaining regulatory integrity and user trust.

Pain point

Heavy Onboarding, Light Guidance

Brex’s onboarding process requires users to provide extensive business and identity verification before accessing any product value. While these steps are necessary for compliance, the experience feels heavy, unclear, and unpredictable — causing uncertainty and reducing motivation to continue.

1

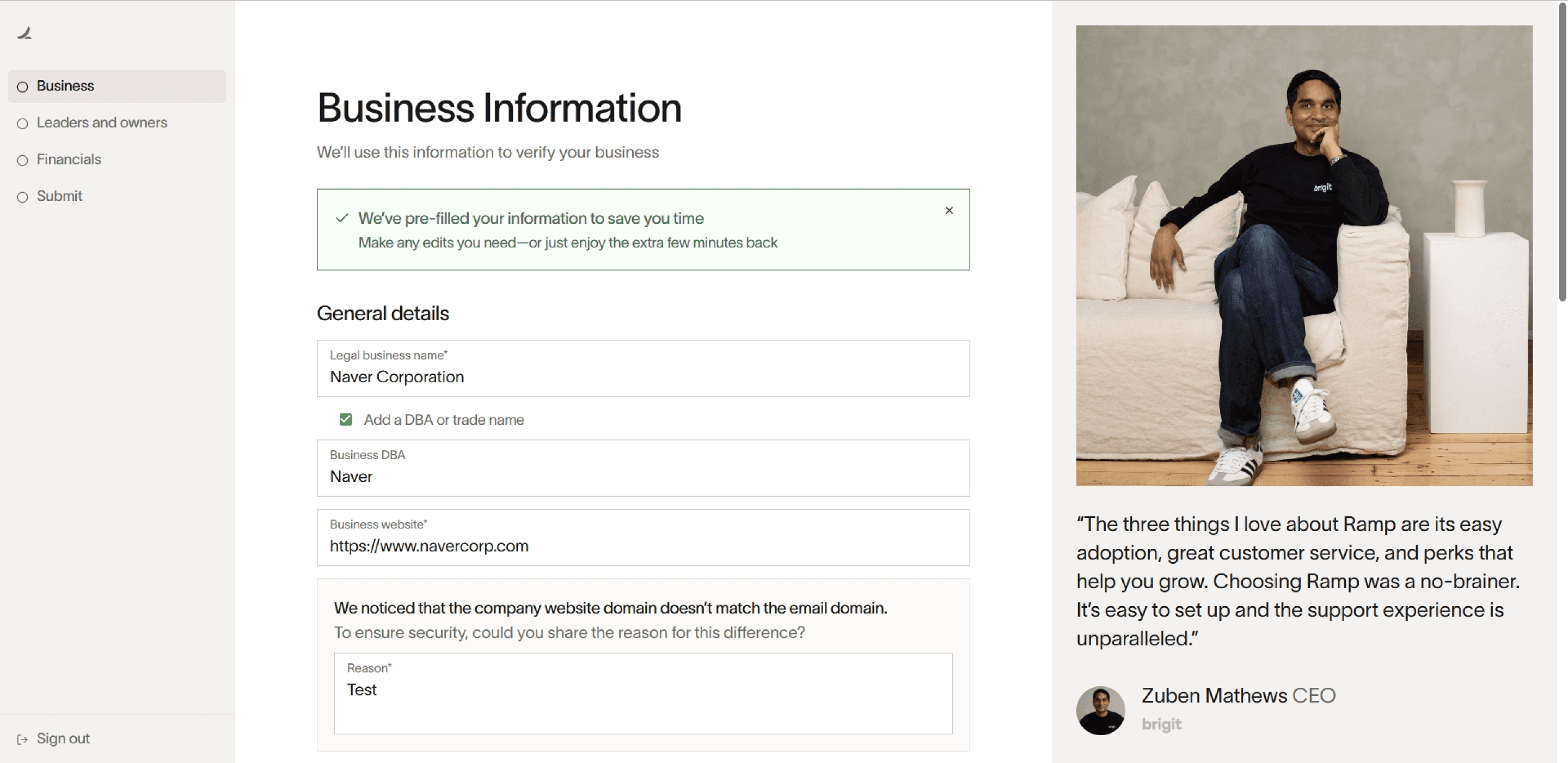

Brex asks users to manually provide business details, identity documents, and owner information without sufficient automation or support, increasing cognitive load, while Ramp provides pre-fill feature based on the business email the user entered earlier.

Brex

Ramp

2

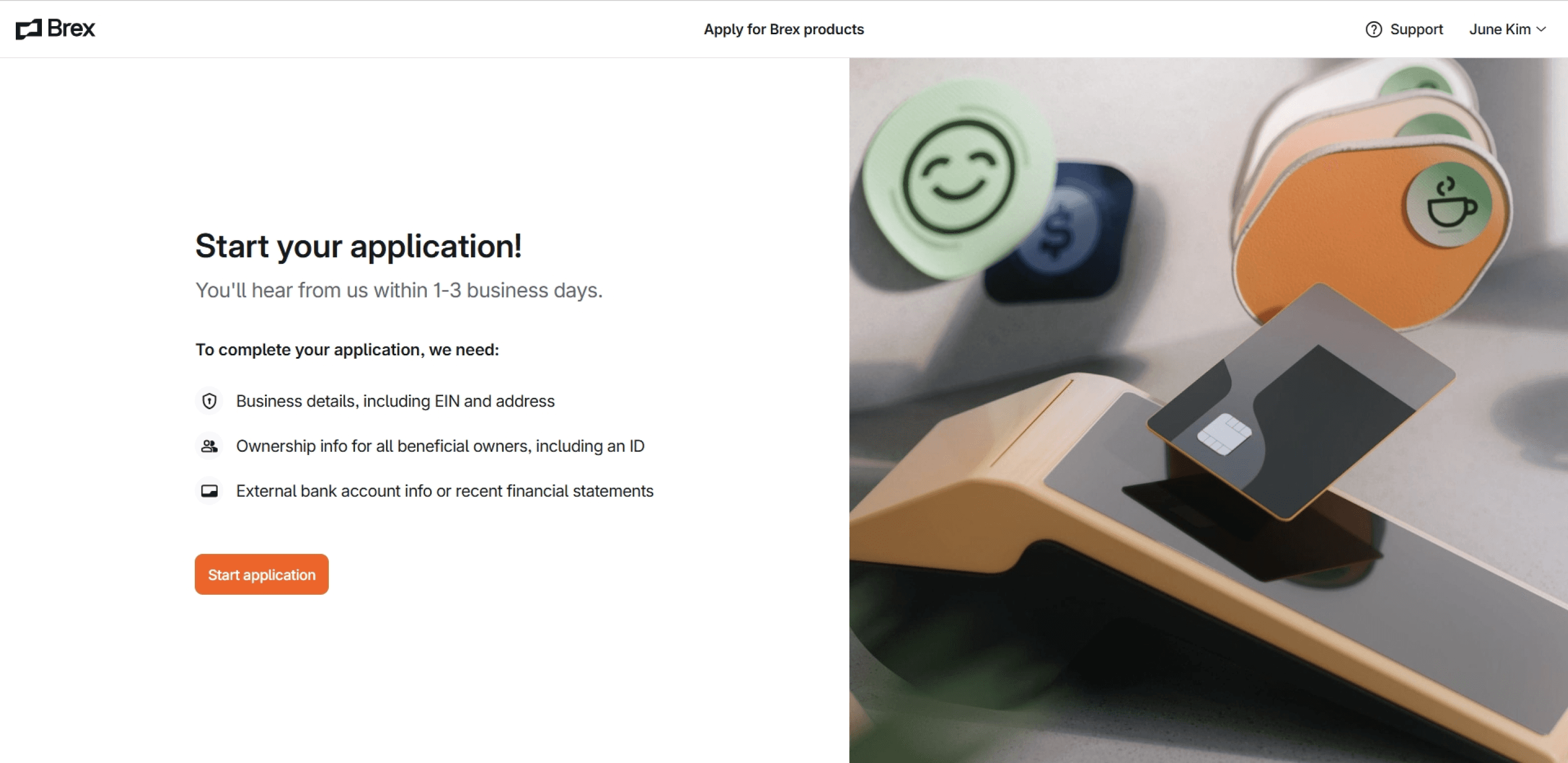

Brex leaves users unsure about how long the application will take or what to expect. In contrast, Ramp offers demo videos and user insights, giving applicants a clearer sense of the product before they commit.

Brex

Ramp

3

Brex’s application includes 17 screens with extensive data collection upfront, while Ramp reduces the flow to 10 screens by requesting only the necessary information.

How might we streamline the onboarding experience

while maintaining compliance and trust?

Research: Financial Compliance & UX Constraints

To understand why Brex's onboarding is more complex than competitors like Ramp, I examined the regulatory requirements that influence financial onboarding flows:

Financial platforms must verify user identity through documents, SSN, address, and government-issued ID.

Corporate cards require validation of company ownership structure, EIN*, incorporation documents, and beneficial owners.

Financial platforms must enforce safe data handling and 2FA(Two-factor authentication).

Regulations create required friction.

But that friction can be redesigned to feel:

✔

Predictable

✔

Guided

✔

Automated

✔

Trust-buidling

Abbreviation reference:

*EIN — Employer Identification Number

*SOC 2 — Service Organization Control Type 2

*PCI DSS — Payment Card Industry Data Security Standard

Solution

AI-Assisted Guided Onboarding

I designed an improved onboarding approach that maintains regulatory compliance while reducing user effort and confusion.

1

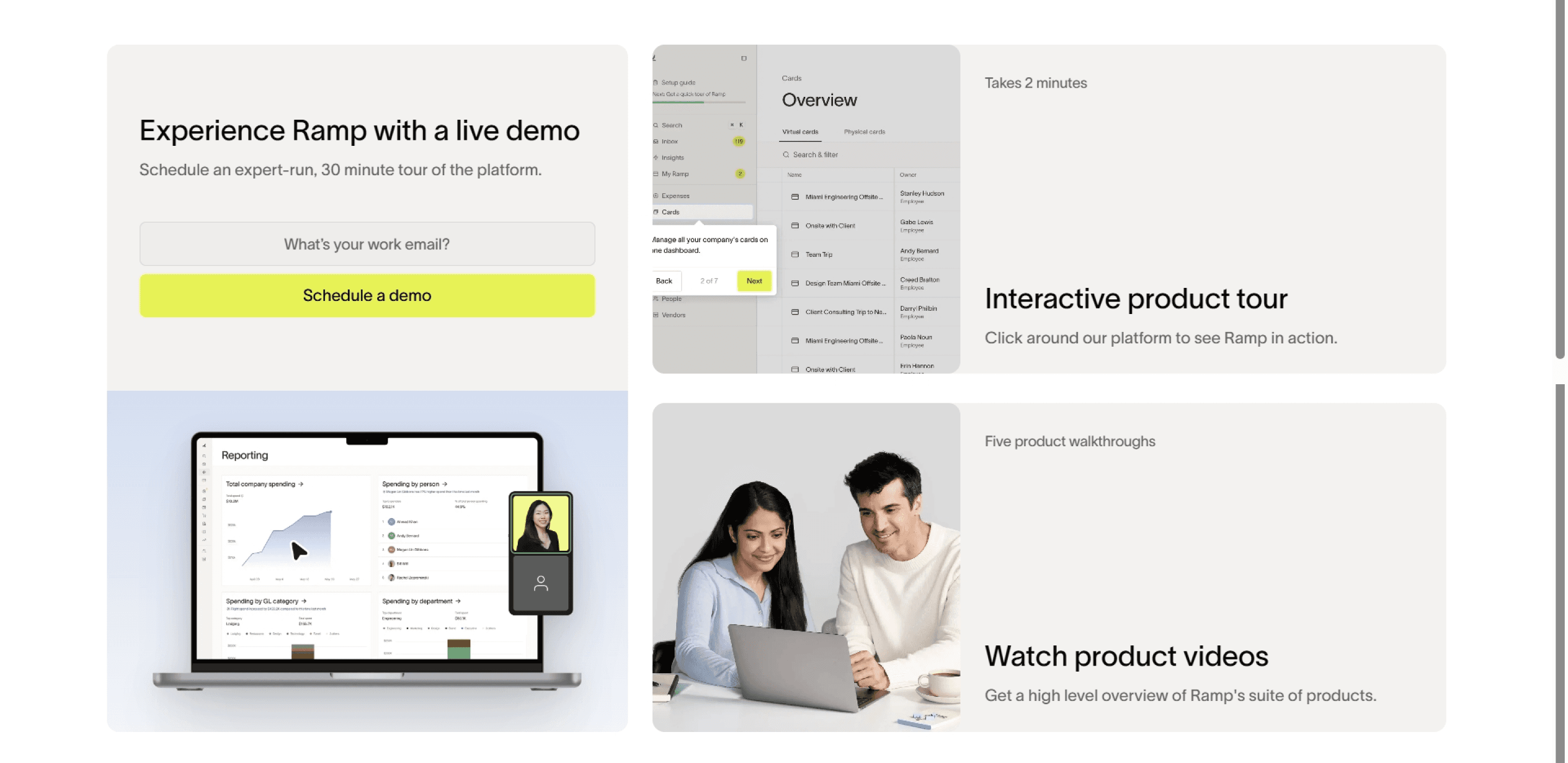

Smart pre-fill with data + AI

Brex can streamline onboarding by using AI-powered pre-fill—pulling business data from IRS/SEC databases and extracting identity details through OCR. Showing estimated completion time and highlighting real product use cases during onboarding can reduce friction, ease user tension, and decrease drop-off rates.

2

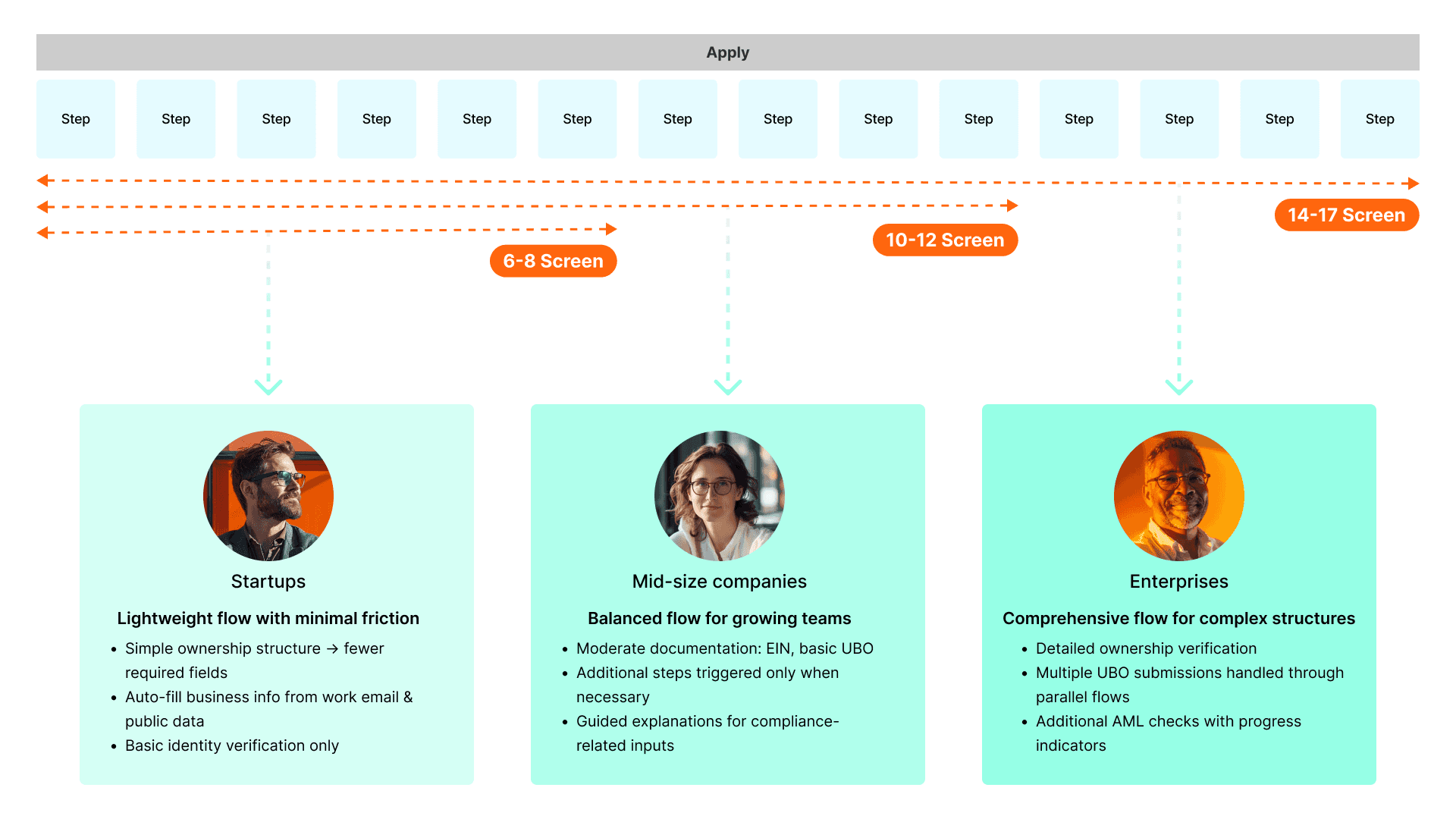

Adaptive application based on company size

Brex already categorizes its customers by company size—startups, mid-size companies, and enterprises. By allowing AI to automatically detect company attributes and route users into the appropriate flow, Brex can reduce unnecessary steps for smaller companies while ensuring deeper compliance checks for larger organizations. This approach minimizes cognitive burden, improves completion rates, and better reflects the true regulatory needs of each customer group.

Impact

A more transparent, guided, and automated onboarding experience that: